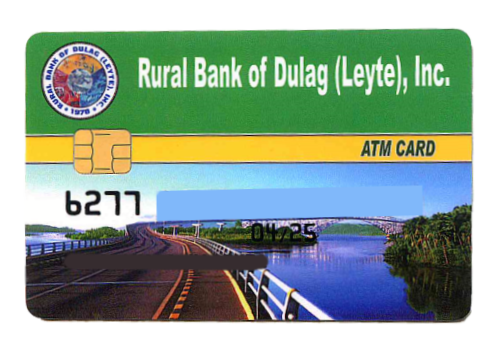

The Rural Bank of Dulag (Leyte), Inc. has completed its migration to microchip-based bank cards, meeting the end-June deadline set by the central bank dated February 21, 2018.

What is EMV?

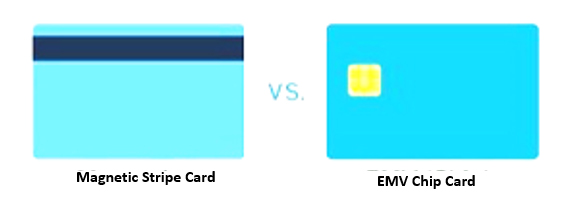

EMV – named after its developers Europay, Mastercard, and Visa, is the global standard for credit, debit, and prepaid card payments using the chip card technology. A card equipped with EMV technology has a computer chip (that looks like a SIM card) embedded on its front side. EMV chip-based payment card is a more secure alternative to traditional magnetic stripe payment cards.

An EMV card contains a microprocessor chip which creates a unique transaction code for each payment, making transactions more secure than the magnetic stripe cards.

What makes EMV different from the traditional magnetic stripe card payment?

The magnetic stripe on traditional credit, debit and prepaid cards contains unchanging (static) data which can be easily copied by fraudsters via a simple and inexpensive skimming device. Unlike a magnetic stripe card, every time an EMV card is used for payment, the chip on the card generates a unique transaction code that cannot be used again. This feature, known as dynamic authentication, makes it difficult, if not virtually impossible, and costly for fraudsters to counterfeit EMV cards.

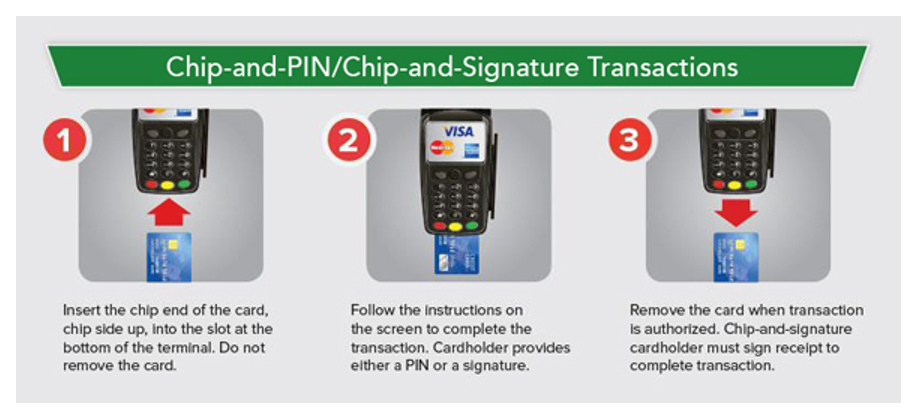

In terms of customer experience, EMV chip-compliant cards are read in what is called “card dipping” mechanism instead of the usual swiping of magnetic stripe cards. Because of the additional validation and data flows for the EMV chip-compliant card, the process may not be as quick as the swiping process. Hence, the customer must be patient and understand the trade-off between security and performance.

The infographic below shows the EMV chip card acceptance/validation process:

Why is there a need to adopt EMV technology in the Philippines?

The EMV chip technology has been proven effective in significantly reducing counterfeit fraud, skimming and other related attacks perpetrated in magnetic stripe payment cards. Consequently, fraudsters have shifted their efforts to countries which are still highly reliant on the magnetic stripe technology, such as the Philippines. Thus, it is imperative for the Philippines to adopt EMV technology to address the increasing rate of counterfeit fraud, safeguard the interests of the public and promote interoperability with international payment networks. Towards this end, the BSP has put in place the necessary regulatory and supervisory framework to enable the migration of the entire payment network to EMV technology. This is fundamental to BSP’s mandate to foster the development of safe, secure, efficient and reliable retail payment systems and uphold consumer protection.

What are the relevant BSP regulations governing EMV migration?

BSP Circular No. 808 dated 22 August 2013

Requires BSP-Supervised Financial Institutions (BSFIs) to shift from magnetic stripe technology to EMV chip-compliant cards, point-of-sale (POS) terminals and automated teller machines (ATMs).

- BSP Circular No. 859 dated 24 November 2014

Provides the EMV implementation guidelines which set forth BSP’s supervisory expectations with respect to management of risks while migrating the payment network to the EMV platform. - BSP Memorandum No. M-2016-011 dated 31 August 2016

Provides guidance on the adoption of chip and Personal Identification Number (PIN) as the primary cardholder verification method for EMV compliant Philippine-issued debit cards. - BSP Memorandum No. M-2016-013 dated 27 September 2016

Requires BSFIs to submit quarterly reports indicating the status of their EMV migration activities and compliance to the BSP. - EMV Card Fraud Liability Shift Framework (ECFLSF)

Establishes the framework which sets forth the general principles in the allocation of liability and resolution of disputes on fraudulent transactions arising from counterfeit cards.

How will the EMV requirement affect

BSP Supervised Financial Institutions?

All BSFIs with card issuing and acquiring functions are primarily responsible for migrating their payment card products and card-accepting devices/terminals to EMV technology in compliance with pertinent BSP regulations. Activities to migrate to EMV include the replacement of terminals (e.g. ATMs), replacement of the software that drives these terminals (i.e. hosts), as well as the replacement of the payment cards (e.g. ATM/debit card and prepaid card) previously issued.

Players in the Domestic Payment Network?

Key players in the domestic payment network should also prepare their respective systems, terminals and network to support EMV technology. These include merchants, providers of ATMs, POS terminals and similar devices, card vendors, card personalization bureaus and domestic switch (BancNet) responsible for processing and handling domestic transactions. Since most of these players normally partner/coordinate with issuing/acquiring BSFIs, it is incumbent upon all affected BSFIs to ensure that these key players comply with BSP guidelines on EMV technology.

Cardholders/Customers?

To protect their accounts from fraudulent transactions arising from counterfeit and skimming attacks, debit, credit and prepaid cardholders should cooperate with their issuing banks in the replacement of their magnetic stripe cards with EMV chip-compliant cards. Consumers are advised to update their contact details with their banks to ensure they receive timely notifications and other advisories (e.g. when they will be issued a replacement chip-based card).

Do we expect zero incidence of counterfeit fraud and skimming upon implementation of the EMV technology?

While EMV technology has been effective in minimizing counterfeit fraud and skimming, it is not a silver bullet or a one-time solution. However, it is far more secure than magnetic stripe technology which is virtually defenseless against card skimming. Given the rapidly evolving cyber-threats and the increasing ability of fraudsters to circumvent existing controls, BSFIs should continuously monitor developments and assess risks pertinent to their payment networks and systems. Likewise, BSFIs should ensure that an interplay of technology, people and processes on top of adequate governance and risk management mechanisms are in place to effectively address emerging payment systems risks and threats.

What Happens if You Don’t Convert to EMV?

Your old ATM card will be deactivated if you fail to claim your EMV card on the deadline set by the bank – JUNE 30, 2018, for non-EMV card replacement. That means you can’t use it anymore to withdraw money from ATMs, pay for your purchases at point-of-sale (POS) terminals, and do online shopping.

In short, your magnetic stripe card will no longer be accepted for any transaction. You can still access your account through over-the-counter transactions at any branch of your bank, but these come with certain fees.

How to Get a New EMV Card

Here are the simple steps to replacing your non-EMV card with a new one:

1. Visit the branch

2. Present a photocopy of at least one valid ID with photo and signature.

3. Present your Old Magstripe ATM card.

4. Wait for the bank to issue your EMV card. You may get it on the same day or several banking days after. Once you receive your new card, the bank will automatically deactivate your old card.

5. Activate your EMV card immediately. You can’t use the card until you’ve activated it. Follow the bank’s instructions for your card activation.

Upon claiming, you will also be asked to update your Customer Information Sheet and Signature Card.

Final Thoughts

Protecting your money in the bank is part of managing your finances well. Don’t think twice or delay swapping your old ATM or debit card to an EMV card—it’s for your own good.